Key Takeaways for Decision Makers

CONTRACTOR: Market shares for Caterpillar appear to expand during summer and shrink during winter months, which are Deere’s strongest months for year over year growth. Volvo and Champion graders, alongside Komatsu and Galion graders, play a small but significant role with Case CE in balancing the market.

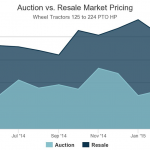

Manufacturer shares of private used equipment markets can be difficult to predict. One might assume that market saturation matters most; if a single producer dominates the new equipment market, then intuitively those models will be more likely to appear in secondary markets after a given time. Yet in some markets, improvements in market shares appear to follow other structures. As an illustration, we constructed a dataset, fueled by MagikMe Equipment Values, from over 113,000 sales records of articulated frame graders on the private resale markets between 2013 and 2014. From that sample, we split the data by year and by the most commonly appearing manufacturers, charting their change in market share in each month from the previous year. The results are displayed in the interactive chart above. Clicking on a data series will hide it from the graph and readjust the frame, which provides some additional insights.

These year-to-year changes illustrate some of the difficulties in interpreting market share. Together, Caterpillar and Deere accounted for 80% to 90% of the resale market for articulated frame graders in both years. As such, their gains and losses have a much greater influence on market volume. Caterpillar and Deere are clearly in direct head-to-head competition for control of this market, never once moving in the same direction in the same month. There also appears to be some seasonality involved in Caterpillar and Deere market shares. Deere improved on its previous year in the early and late months of 2014, but experienced small losses in market share over the summer months. Caterpillar, on the other hand, saw significantly reduced market share in the first quarter of 2014 compared to 2013, but gained a substantial amount during summer months.

The Galion and Champion brands seen here as minor players in the articulated frame grader market also reveal an interesting feature of this market—namely, that grader makers tend to have a lot of staying power. Galion Iron Works produced articulated frame graders until 2003, even after purchase by Komatsu in 1994. Similarly, Volvo acquired Champion in 1997. Yet, even in 2013 and 2014, these two brands are still within the top eight brands of articulated frame graders. The fact that this occurs is an affirmation of their quality, but also the way in which they are slowly declining as key contributors to this market.

It is interesting to note that April, July, and September of 2014 showed the least expansion or decline in market share for these manufacturers. Additional research would be required to establish the exact impact of seasonal trends, but even with these summary statistics, we observe several important facets of this market. Namely, that Deere and Caterpillar’s race for market control will likely continue unabated, and that while still somewhat significant, the Galion and Champion brands will likely continue to fade into the background behind Komatsu and Volvo, their respective parent companies.